Tips on how to get a fair price for your house

When the appraised value of your home comes in lower than anticipated, it may be quite discouraging to have your loan application refused or the loan amount reduced. Here is a list of methods that have shown to be effective in getting a good one.

Investors often have the valuations of their current assets reviewed to generate funds for new investments. Take the following into account, your home is now $50,000 more valuable. Most loan companies would likely give you a loan for 80 percent of that value, or roughly $40,000. A down payment on another property might be made using these funds. Lenders often send out property valuers to meet with borrowers in person to get an exact loan amount. As a result, we've spoken with several experts in the field of property valuation to get their insight. How can one guarantee the highest potential rate of return for their investments?

What the Experts Say?

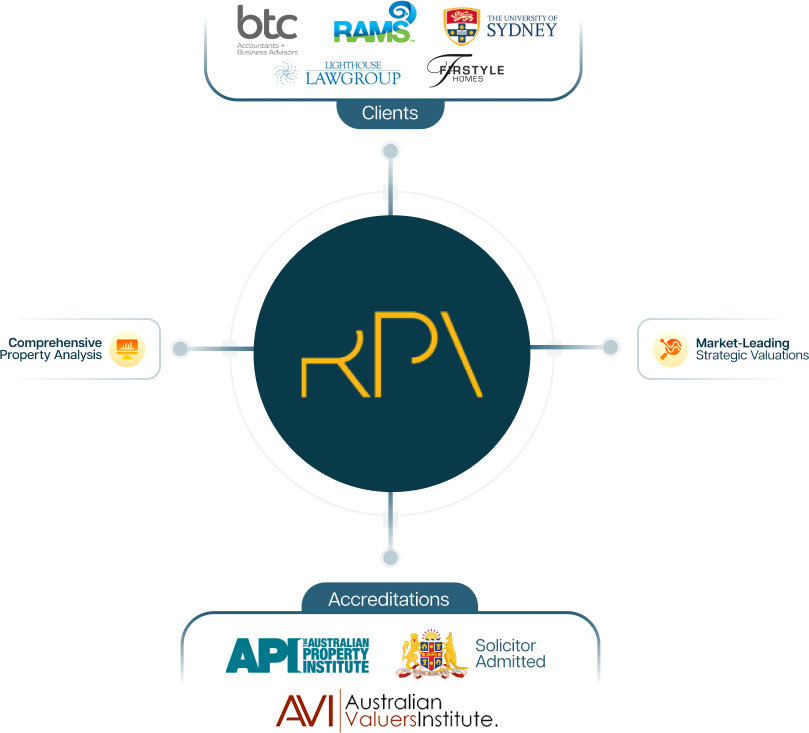

According to the expert, the location and size of the land, as well as the size and functionality of the house, are the most significant factors in determining a value. Therefore, it should come as no surprise that the property you initially opted to acquire is the key element impacting the chance of a favourable evaluation. Of course, the status of the real estate market at the time in question also plays a role. However, our experts say there are a few things you can do to guarantee the highest potential worth on that particular day. Here you can find further information about the subject. For that you need the property valuation Sydney service there.

Presentation

The owner must guarantee that the property is in good working order before the inspection. Nothing is more annoying than visiting a house for an appraisal only to discover two weeks' worth of dirty clothes spread out on the bedroom floor, the toilet seat still up, and last week's dirty dishes still in the sink.

Evidence of Recent Sales

If you know the prices that neighbouring properties have recently sold for, be prepared to provide that information with the property appraiser.

One of the best times to get a current value is when there have been two or three recent sales that are quite similar to the property being appraised. It's not hard to see how anything like this might affect the overall worth. The most convenient way to keep tabs on local bargains is to frequent auctions in the area. Whether the sale was at auction or by private agreement brings the sales brochure with you to the open house so that your valuer may contact the agent and confirm the sale price. Choosing the residential property valuer is a nice idea here.

Conclusion

If you want to impress certain appraisers, bring a copy of your local municipality or council's rates. Although they vary from place to place, it is common to find a monetary figure known as the "site value" or the "unimproved land value" that represents the value of the land itself. In economics, this number serves as a "base value." An "improved value," which factors in both the land and the building, is also an option. Those numbers were derived by a statistical analysis. As a result, it is not an exact figure, but it does give us a rough idea, and it gives the valuer a good idea of where it sits in the market.

Comments

Post a Comment